By Tom Sedoric and Casey Snyder

In the United States, a slip and fall resulting in a broken bone can lead to complete financial ruin. According to research from 2019, an estimated 530,000 families file for bankruptcy each year due to medical issues and bills alone. It’s hard to imagine that figure went down at all since the start of the COVID-19 pandemic, which has led to unemployment, illness, and the breakdown of our health systems. For a country that likes to fashion itself “first world,” the U.S. has done a poor job of making healthcare widely available - let alone affordable - for its citizens.

The looming threat of exorbitant medical expenses is a cloud over most all of us. As we know, the unexpected can—and does—happen, and it’s critically important that we’re prepared when it does so we don’t end up losing everything as a result. There’s very little we can do as individuals to influence change in the healthcare system itself, but we can take steps to mitigate the impact of medical expenses on our personal financial lives.

Why Are Medical Expenses Rising?

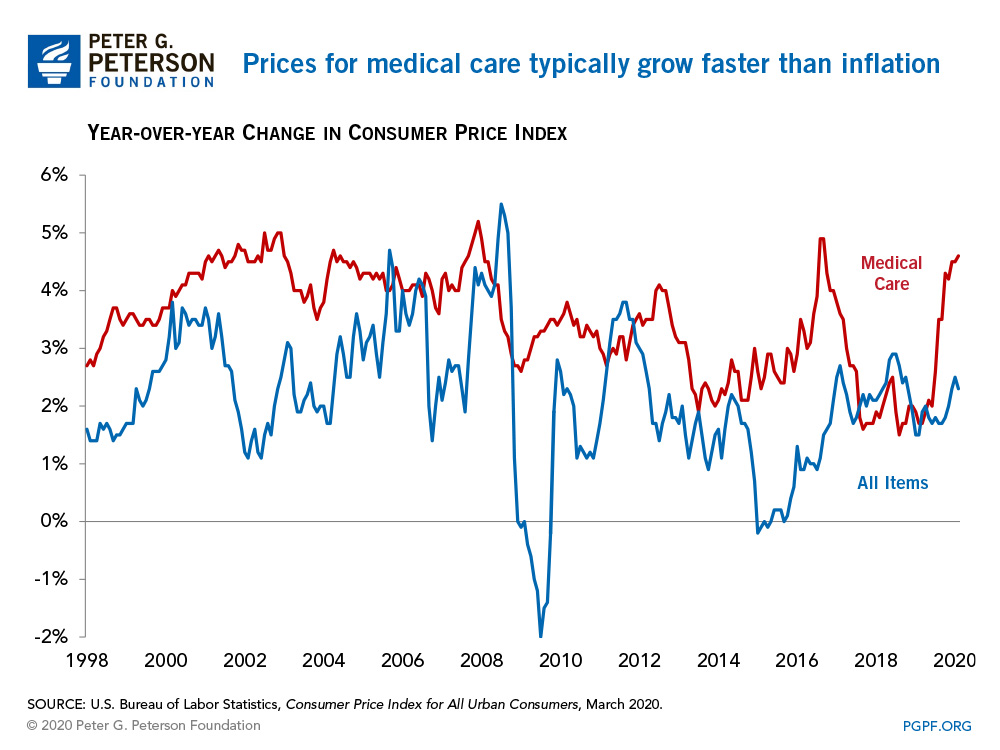

First, let’s dig into the rotten core of the U.S. healthcare system. In 2018 alone, we spent about $3.6 trillion on healthcare, which averages to about $11,000 per person. Experts anticipate that this will increase to about $18,000 per person by 2028, and these costs show no sign of slowing. In fact, the cost of healthcare services has risen faster than any other goods and services in the economy, even surpassing the growth rate of our annual GDP.

What’s causing this? There’s a variety of reasons, including newer, high-tech procedures that cost more, administrative waste, higher salaries for doctors and nurses, and monopolies created by merging healthcare systems. Also, Americans spend nearly four times more for medications as citizens of other developed countries. All these factors have snowballed and landed on the shoulders of the rank and file citizen.

The cost of providing care is rising, and at the same time, the population of this country is aging. More than 20% of the population will be over the age of 65 by 2030 and, as we all know, we need more medical care as we age. We’re helping people live longer, therefore spending more on healthcare over their lifetime. To put it in perspective, the average person spends about $316,600 on healthcare throughout their life—a figure that’s even higher among women, who have longer life expectancies than their male counterparts.

We can and should expect to see medical expenses continue to rise. We also can—and must—prepare for personal medical expenses that may arise.

Steps You Can Take

There’s no reason not to start shoring up your finances as soon as today. In fact, if you haven’t already started, then you’re behind. Start by making sure you have all your ducks in a row. This includes reviewing your life and health insurance policies (or taking one out if you haven’t already), purchasing disability insurance, and potentially opening an HSA. You’ll want to use your HSA to save more than your typical annual health expenses, which will ensure you have some breathing room in case of an unforeseen medical event.

Another key step to take is to work medical expenses into your spending plan—both for today and during retirement. Accounting for these costs will help you make smarter money decisions, even if you avoid a major health event.

Then take a look at your overall saving and investing strategy. Tax efficiency is another significant piece of the pie here. Balancing your pre-, post-, and tax-deferred investments ensure that you’re able to maximize your return later in life. We also recommend meeting with a fiduciary, who can help you start practicing tax-efficient investing and give you insights into your preparedness for unforeseen medical expenses.

As you age, it’s important to be completely prepared for any unexpected major health events that may arise. Otherwise, you run the risk of derailing your retirement plans that you’ve worked so hard and saved so long for.

The Sedoric Group of Steward Partners

Steward Partners Global Advisory

145 Maplewood Avenue, Suite 100

Portsmouth, NH 03801

(Office) 603-427-8870

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Please note that the URL(s) or hyperlink(s) in this material is not to a Steward Partners Investment Solutions, LLC website. It was created, operated and maintained by a different entity. Steward Partners Investment Solutions, LLC is not implying an affiliation, sponsorship, endorsement with/of the third party or that any monitoring is being done by Steward Partners of any information contained within the linked site; nor do we guarantee its accuracy or completeness. Steward Partners is not responsible for the information contained on the third party web site or the use of or inability to use such site.

Securities and investment advisory services offered through Steward Partners Investment Solutions, LLC, registered broker/dealer, member FINRA/SIPC, and SEC registered investment adviser. Investment Advisory Services may also be offered through Steward Partners Investment Advisory, LLC, an SEC registered investment adviser. Steward Partners Investment Solutions, LLC, Steward Partners Investment Advisory, LLC, and Steward Partners Global Advisory, LLC are affiliates and separately operated.

Adtrax 5727939.1 Exp 5/25