By Tom Sedoric and Casey Snyder

In times of conflicting economic news – such as rising inflation and interest rates, and the seismic impact of the largest ground war in Europe since 1945, just for starters – it’s not unwarranted to wonder if the global economy is being stirred to serious turmoil like the three witches (or weird sisters) in Shakespeare’s “Macbeth” foretold.

“By pricking of my thumbs/Something wicked this way comes,” said the second witch.

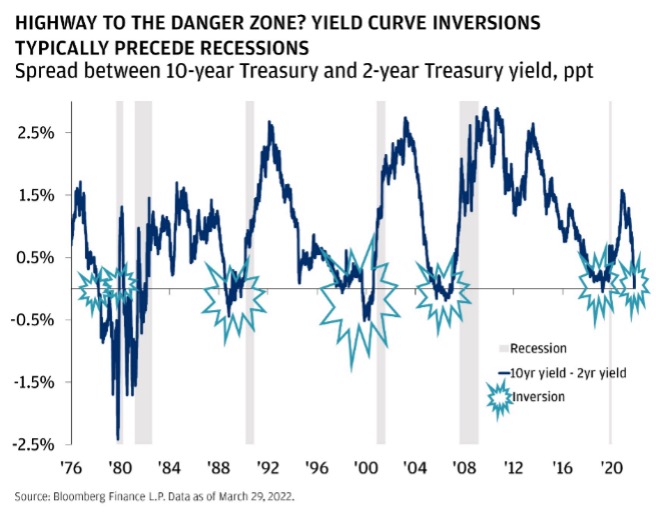

A few weeks ago, economists and market watchers took note as the bond market phenomenon known as the Inverted Yield Curve took place. Translated into layman’s terms, this means that the 2-year and 10-year Treasury yields inverted, with the 2-year note drawing a higher yield than its 10-year cousin. The Economist ran a story on April 22nd titled “The Fed That Failed,” in describing how the Fed has lost control of inflation and hence, the economy.

In practical terms, for most people, this means nothing to their day-to-day lives or even their immediate investments. But when the inversion happens – the last time it happened was March 2019 – it could become the economic version of “something wicked this way comes.” Inversions are rare and often are a leading indicator that a downturn could take hold in the next 12 to 18 months. The inversions were one indicating prelude to five recessions from 1980 to 2020.

Psychologically the inversion can be seen as a pessimistic vision of future economic conditions, with 2-year notes offering better yields than 10-year notes. Healthy bonds are as conservative as you can get in a diversified portfolio, and in the first quarter, the overall bond market took its most severe hit since 1973. The major igniter then was the first Arab oil embargo which shook markets and recalibrated the prices of everything, and was the catalyst for a weakened and sluggish economy for most of the next decade.

The context today is justified concern as the global economy reckons with:

- Continued fallout from the Covid-19 pandemic (see Shanghai below).

- Global-wide inflation driven mostly by volatile energy and food prices caused partly by the war in Ukraine. This food portion of the crisis will particularly hit third-world countries who import and depend on food aid.

- Supply chain issues. The Covid-19 lockdown in Shanghai, courtesy of the Chinese government’s ‘zero-Covid policy, has left hundreds of large cargo ships stranded off one of the world’s largest ports, unable to dock and load supplies, parts, and finished products for multi-national corporations.

- The cumulative long-term economic, environmental, and geopolitical consequences of the Russian invasion of Ukraine.

As you can see from the small list above, all the issues are interconnected and not easy to untangle, making forecasts even more treacherous. The Federal Reserve's action to raise interests by at least 2.5 percent in the coming year is an attempt to tame the growing menace of inflation. This charge by the Fed is expected, even welcomed. If the domestic and global economies take a serious tumble downward, the Fed would have little policy ammunition if interest rates remained around zero.

We have coined the term ‘coflation’ and how inflation or deflation are not an equal opportunity pain distributor. The same could be said about how rising interest rates may burst or flatten the ongoing housing bubble (exacerbated by historically low-interest rates) or how those on fixed incomes may benefit. For retirees and investors who can ill afford the risk of a 100 percent equity portfolio, higher rates could even be welcomed. One aspect is clear: despite the perceived safety of most domestic and foreign equities markets, a massive price recalibration is taking place and will likely impact every sector of the economy.

We urge our clients to stress test their portfolios to reassess their plans and levels of risk. We have been sailing in unchartered economic waters of one unexpected shock after another since the pandemic lockdowns began more than two years ago. Batten down the hatches as we expect continued turbulence going forward.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of The Sedoric Group of Steward Partners and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Investing involves risk, and you may incur a profit or loss regardless of strategy selected. Individual investors' results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed; investment yields will fluctuate with market conditions.